If You’re Taking Out a Loan for These Reasons… Then You should Think Again!

People often approach banks for loans due to home repairs or car purchase or business loans, but recently a few desperate folks approached banks for crazy personal loans. Approaching a financial institution or bank for a cosmetic or plastic surgery loan or even repaying back your credit card debt are some weird examples. People are so addicted to shopping that they often have to borrow money from the bank, a friend or a Credit Card Company for some stupid purchase. Here’s why YOU should avoid them!

Wedding:

As it is a wedding season, this reason tops the list. People insist on classy and expensive weddings, despite their pockets not being able to sustain it. But many couples don’t mind starting their lives with a major debt on their hands and approach credit card companies or banks or to come rescue them.

Loan meant for a friend:

At times, a girlfriend or a boyfriend takes loans for their may-be spouse, without thinking about a breakup between them. If lending money to a friend, consider that money as a gift, without any paybacks; consider yourself lucky if you get a payback. But a loan for your girlfriend is a total blunder because if they split up, the person who bears the loan liability, legally has to repay it.

For festivals:

In USA, every year hundreds of people take loans during Christmas and this is not an intelligent idea. Such stupidity makes your financial status worse. Instead of sad faces of your children on Christmas morning and rushing for a loan, do try and plan ahead for it. You could save money by monitoring expenses during the year and save enough for Christmas purchases.

Investing in stock markets:

It just does not seem that that you’re taking a loan for unpredictable returns. Stock market investment is for those with extra bucks in their pockets and who take chances on losses. You cannot justify taking debt to become more indebted. Instead of loans for stock market gambling, have a decent job, earn some money, save it and thereafter invest in stocks after planning future expenses.

Pay Day loan:

Why take loans and pay the interest till your next salary? Instead why not save some money from your pay, spend wisely and avoid being indebted.

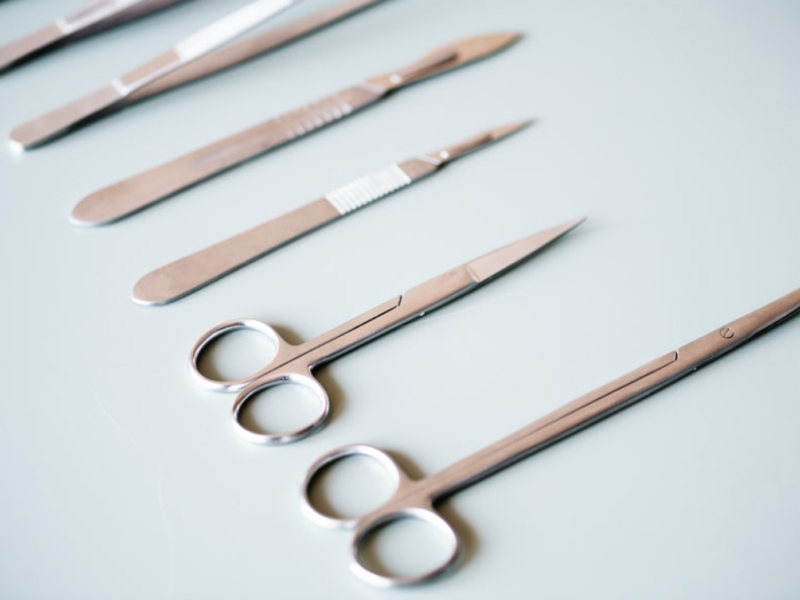

Plastic Surgery:

People take loans to invest in ventures to cover the loan amount and the interest payments. But can you pay back after taking a loan for a plastic surgery procedure, unless your job pays you extra for your enhanced looks? There is no rationale for such irrational financial planning.

The pre-retirement loan:

People in US opt for a pre-401K loan and borrow money out of their retirement plan which the government-mandates for every citizen. This act is very disappointing as this makes you underprivileged but also takes away your retirement security. Funds from this retirement arrangement are not taxed until withdrawal, and an early withdrawal penalty (10%) is levied on the amount withdrawn. This stupid decision often lures people into very complex tax situations.

Vacation Loan:

Vacations are great stress busters, but why start a stress-busting vacation with a debt? But the shocking fact is that more people do this without giving a thought about landing in a critical financial hell. They can never be stress-free on a loaned vacation. It’s better to work hard, save money and then plan for holidays.

More inFinancial Advisory

-

Katy Perry’s Real Estate Journey: Legal Battles and Property Pitfalls

Katy Perry, the pop sensation known for her chart-topping hits, bold fashion choices, and stint on American Idol, has been making...

December 15, 2023 -

What To Do When Markets Are Volatile?

Market volatility refers to the frequency and magnitude of price movements in financial markets. It is like the weather of the...

December 7, 2023 -

The Cheapest Days to Book Flights and Travel

When it comes to snagging the best deals on flights and travel, timing can be everything. It is like finding that...

November 27, 2023 -

The 4 Optimal Times to Consider Rebalancing Your Portfolio

Navigating the investment world is like hopping on a roller coaster—ups, downs, twists, and turns galore. Whether you’re a hands-on trader...

November 26, 2023 -

Buying a House? Understand You Are Buying a Liability, NOT an Asset

In the grand tapestry of life goals, owning a house is often stitched in golden thread. It is the culmination of...

November 19, 2023 -

How to Tell If You Are Financially Prepared for Change

So, you are contemplating a big life change, huh? Maybe you are considering relocating to a new city, pursuing a new...

November 9, 2023 -

The Best Foods to Eat Before a Flight

Flying can be an exhilarating experience, but it can also be physically demanding. Long lines, security checks, and cramped seats can...

November 3, 2023 -

How to Spot a Bull Market Return: Signs to Look Out For

When it comes to Wall Street, or the investing world at large, investors and traders dream of catching the wave of...

October 26, 2023 -

Become a Millionaire Before Getting Retired | Fidelity’s Ultimate Retirement Advice

We have all daydreamed about it at one point or another: sitting on a pristine beach with the sun kissing our...

October 19, 2023

You must be logged in to post a comment Login