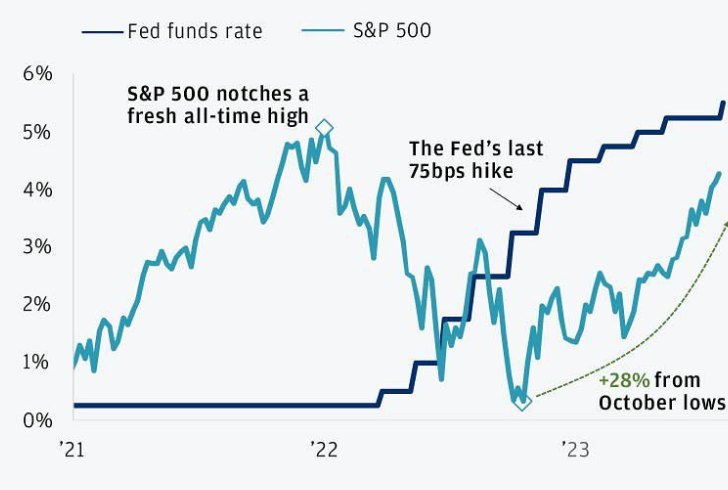

The Prolonged Impact of Fed Rate Hikes on Our Economy

More inTrade & Markets

-

Katy Perry’s Real Estate Journey: Legal Battles and Property Pitfalls

Katy Perry, the pop sensation known for her chart-topping hits, bold fashion choices, and stint on American Idol, has been making...

December 15, 2023 -

What To Do When Markets Are Volatile?

Market volatility refers to the frequency and magnitude of price movements in financial markets. It is like the weather of the...

December 7, 2023 -

The Cheapest Days to Book Flights and Travel

When it comes to snagging the best deals on flights and travel, timing can be everything. It is like finding that...

November 27, 2023 -

The 4 Optimal Times to Consider Rebalancing Your Portfolio

Navigating the investment world is like hopping on a roller coaster—ups, downs, twists, and turns galore. Whether you’re a hands-on trader...

November 26, 2023 -

Buying a House? Understand You Are Buying a Liability, NOT an Asset

In the grand tapestry of life goals, owning a house is often stitched in golden thread. It is the culmination of...

November 19, 2023 -

How to Tell If You Are Financially Prepared for Change

So, you are contemplating a big life change, huh? Maybe you are considering relocating to a new city, pursuing a new...

November 9, 2023 -

The Best Foods to Eat Before a Flight

Flying can be an exhilarating experience, but it can also be physically demanding. Long lines, security checks, and cramped seats can...

November 3, 2023 -

How to Spot a Bull Market Return: Signs to Look Out For

When it comes to Wall Street, or the investing world at large, investors and traders dream of catching the wave of...

October 26, 2023 -

Become a Millionaire Before Getting Retired | Fidelity’s Ultimate Retirement Advice

We have all daydreamed about it at one point or another: sitting on a pristine beach with the sun kissing our...

October 19, 2023

You must be logged in to post a comment Login