Should You Buy Silver or Gold? 5 Things Investors Look at When Deciding

You finally decided to buy precious metals for investment. And among the top four choices, you’re stuck between gold and silver. You ask yourself what difference it makes if you purchase one instead of the other. Well, there are technically 5 distinctions to know which to invest on. Being aware of these can help up your investment portfolio.

The Silver Price is More Volatile

The metal is more sensitive to price fluctuations.

Every year, total supply of silver is around 1 billion ounces. On the other hand, gold has an annual supply of 120 million ounces. By merely looking at these figures, it’s easy to think that the silver market is bigger than gold’s. In reality, however, silver has a lower price compared to gold. This makes the value of silver’s annual supply actually lower than gold’s.

Silver is more volatile compared to gold because a small amount of money can have greater impact on its price. On the days when silver hits high, it rises more than gold and consequently falls more than gold during its down days.

In case you decide to invest in silver, be emotionally prepared for the high volatility of silver in the market. Selling silver requires better tactics compared to selling it right away in its first big drop. But fret not on silver’s volatility. Silver will have better performance than gold in bull markets. It sells better than gold, so whenever the bull market is peaking, sell that silver!

Silver is More Affordable

How so? Silver shares many similarities with gold. Buying material silver is just like buying physical gold. It’s a hard asset unlike digital trading, paper profits, and cryptocurrencies. Just like gold, silver can’t be hacked. In addition, silver is money. Unlike paper currency, individuals can’t just create silver out of nowhere. Thus, it can’t depreciate. History even proves that coinage uses silver more often than gold.

Silver is a more affordable gift compared to gold.

People invest in silver because they gain an advantage: they acquire the benefit of gold at a cheaper price because of its many similarities. This is why people call silver the “poor man’s gold”. If your current standing is not that much high yet, silver may be your option before you level it up to gold. Because of its affordability, the metal can help you maintain your standard of living.

When it comes to purchasing, giving away gold may make it harder for you. In the same manner, silver makes it more practical spending on smaller purchases. Some people use gold for the bigger buys like a house. But silver will make do for smaller ones like groceries. As an investor, you’ll also find it more affordable to give silver as a gift compared to gold (unless the recipient is really special to you). It just makes sense that investors must have some silver for these reasons.

Silver Requires Much More Storage Space

On the flip side of the coin, affordability comes at a price. For the same amount of purchase between silver and gold, you’ll obviously have more of the previous compared to the latter. In addition, most silver is actually denser than gold. It has a volume that’s 84% larger. For comparison’s sake, a purchase of $50,000 worth of gold fits in your hand whereas you will need 10 large-sized shoe boxes to contain the same dollar amount of silver. So to speak, you will need more storage space if you want to buy silver and you’ll end up paying more for storing it. For example, GoldSilver charges 0.385% for gold per month, and 0.485% for silver.

Lastly, pure gold does not tarnish whereas silver eventually does. Keeping silver requires better storage conditions: store it in a dry place that has no exposure to the elements. Gold doesn’t need this.

Silver Has Higher Industrial Use

Silver has more industrial use compared to gold.

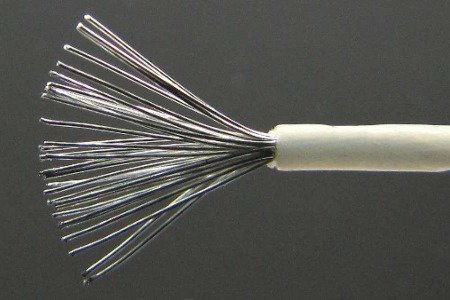

Compared to gold, 56% of silver supply goes to industrial uses. On the other hand, the industry only uses 12% of gold supply. We may not see it directly but most of the products we use on a daily basis contains silver. Mike Maloney shares in his book that silver is the most indispensable of materials out of all the elements. This metal is conducts electricity the most and is thermally conductive and reflective. We see it in electronics, batteries, solar panels, and even in medical applications.

It’s important to note that the global economy’s status impacts silver demand over gold. Therefore, silver is actually more susceptible to whatever economic boom is going on.

Silver Stockpiles are Falling, Gold’s are Rising

Investors may not see this directly. But when we try to look at it through how silver use is managed, this becomes a relevant distinction.

Coinage often uses silver

Back in the day, governments used silver for coinage more often than gold. But as technology advances, creation of coins didn’t use the precious metal anymore. A twin effect of the technological age, however, means that silver is in high demand in the industry (think of computers, gadgets, electronic conductors). Simple economics will tell you that as demand rises with the supply at the same rate (or even decreases), the cost will go higher.

This is good news for the silver investor. Even if it has chances of not becoming a reality, the usage of silver and its supply can impact investors and the silver market alike.

More inTrade & Markets

-

Giant Car Retailer Carvana ‘Tightens’ Its Lending Rules Amid Rise in Delinquencies

In the wake of rising delinquencies, online car retailer Carvana has made significant adjustments to its lending rules. The company is...

June 26, 2024 -

Landlord Mortgage Crisis – What’s the Impact on UK Housing?

In recent years, the UK’s housing crisis has dominated political and social discourse. Sir Edward Leigh, a Tory grandee, highlighted the...

June 21, 2024 -

10 Unique Things to Do in Tokyo for Couples in 2024

Tokyo is a city where the extraordinary is the norm. From towering skyscrapers to tranquil gardens, this bustling metropolis offers an...

June 13, 2024 -

How to Make Money on TikTok – 8 Proven Strategies

TikTok isn’t just a platform for viral dance challenges and funny skits anymore. It’s a goldmine of opportunity for creative minds...

June 6, 2024 -

Tech Giant Cisco Likely to Lay Off ‘Almost 350’ Employees As Part of Its ‘Restructuring Plan’

Is your favorite tech company feeling the pinch? Recent reports suggest that Cisco (CSCO) is planning to lay off ‘almost 350...

May 31, 2024 -

How Many Mortgages Can You Have? Understanding the Limits

Are you pondering the idea of delving into the realm of multiple mortgages? Whether it’s for expanding your property portfolio, securing...

May 23, 2024 -

What You Ought to Know About Dominican Republic Rum

When you think of the Dominican Republic, your mind might drift to images of beautiful beaches and vibrant dance rhythms. But...

May 16, 2024 -

Are Mobile Homes Worth Investing? A Deeper Look

Are mobile homes a good investment? This question often pops up among potential homeowners and investors alike, looking for an affordable...

May 9, 2024 -

10 Best Stocks to Invest in 2024 for Smart Investors

In a world where economic growth seems to be hitting the brakes, the hunt for the best stocks to invest in...

April 30, 2024

You must be logged in to post a comment Login