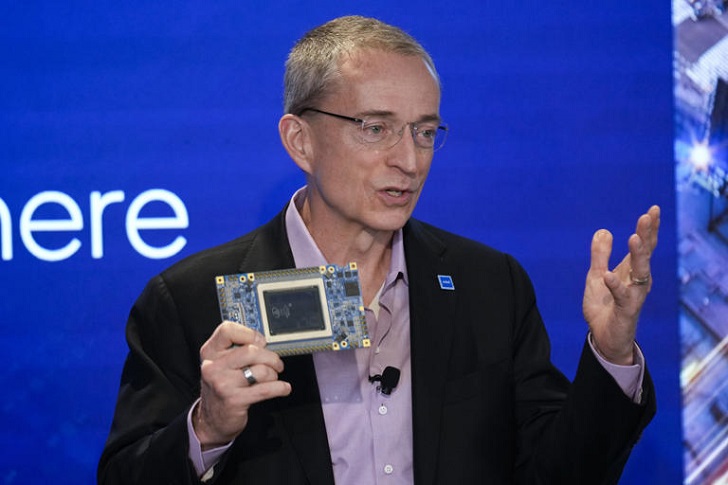

Intel CEO Pat Gelsinger Steps Down After Poor Performance

Intel’s CEO, Pat Gelsinger, has stepped down following a contentious board decision, marking the end of a turbulent tenure. Gelsinger’s nearly four-year leadership saw Intel struggling to maintain its position in the semiconductor industry as market share and stock prices declined dramatically. The decision follows ongoing concerns over Intel’s inability to compete with rivals like Nvidia and the faltering execution of its turnaround strategy.

Intel CEO Departure Sparks Leadership Changes

The company announced the leadership change early Monday, revealing that CFO David Zinsner and Intel Products CEO MJ Holthaus will act as interim co-CEOs. Longtime board member Frank Yeary has been appointed interim executive chair. Intel’s stock fell 2% following the news, reflecting investor uncertainty about the company’s direction amid these sweeping changes. Yeary, a key driver in Gelsinger’s ouster, now faces the challenge of navigating the CEO search process.

Gelsinger’s departure underscores the company’s growing struggles, including dissatisfaction with his ambitious yet costly plans to revitalize Intel. These plans aimed to position the company as a leading chip manufacturer, but their execution left investors and analysts concerned about Intel’s financial stability and competitive viability.

Asa Fitch | MSN | Intel announced the leadership change, revealing that CFO David Zinsner and Intel Products CEO MJ Holthaus will act as interim co-CEOs.

Gelsinger’s Ambitious Plans, Diminishing Returns

When Gelsinger returned to Intel in 2021, he set out to rebuild its dominance in the semiconductor space. His strategy involved large-scale investments in manufacturing facilities in the U.S. and overseas. While these efforts secured government funding under the CHIPS and Science Act, including a $7.86 billion grant finalized just last week, they placed enormous strain on Intel’s financial resources. High spending on manufacturing expansion significantly increased the company’s debt load, raising questions about long-term profitability.

Gelsinger also emphasized Intel’s role in national security, securing lucrative contracts with the U.S. Department of Defense to produce secure chips. However, these initiatives failed to mitigate the company’s mounting challenges, as Nvidia surged ahead in market capitalization, buoyed by the artificial intelligence boom.

Financial Struggles and Investor Skepticism

Intel’s financial performance during Gelsinger’s tenure painted a troubling picture. In August, the company reported disappointing quarterly earnings, triggering its steepest stock sell-off in five decades. Intel announced plans to cut over 15% of its workforce as part of a $10 billion cost-reduction strategy. Despite these measures, the stock price remains 52% lower year-to-date, and the market cap has plummeted to less than half of its 2021 valuation.

Investor confidence in Intel continued to erode, with speculation that activist investors might target the company. Reports suggest Intel had engaged advisors to counter potential activist interventions, reflecting the board’s concern over external pressures. Qualcomm’s interest in acquiring Intel’s foundry business added another layer of complexity to the company’s struggles.

Leadership Void Raises Concerns

Gelsinger’s ouster reignites scrutiny over Intel’s corporate governance and strategic decision-making. The board’s prior decisions, including missed opportunities to acquire Nvidia or secure a chipmaking mandate for Apple, created long-term competitive disadvantages. These missteps, compounded by Gelsinger’s aggressive spending strategies, left the company vulnerable.

Additionally, Intel’s board lacks directors with semiconductor expertise following the departure of Lip-Bu Tan earlier this year. This absence has raised questions about the board’s ability to provide effective oversight and guide the company through its current challenges. Reports of dysfunctional corporate acquisition strategies and internal discord further highlight governance issues.

A Challenging Road Ahead for Intel

Intel’s new leadership must grapple with a more challenging and competitive landscape. The foundry business restructuring, announced in September, aims to create an independent subsidiary capable of attracting external funding. While this move could offer some financial relief, it underscores Intel’s ongoing struggle to regain its competitive edge.

The next CEO will inherit a company that has lost significant market share and investor trust. Rebuilding Intel’s reputation and addressing its operational inefficiencies will be a monumental task requiring strategic clarity and decisive action.

You must be logged in to post a comment Login